I just finished reading a Yahoo Finance article titled Amazon paid a 1.5% tax rate on $13,285,000,000 in profit for 2019. This is a common theme, especially in political discussions. I often read and hear about how evil corporations don't pay their fair share in taxes. But I want to explain why this is a good thing and why corporations that pay no federal taxes should be celebrated.

First of all, I'm talking about larger corporations here, which are typically C Corporations. Amazon.com, Inc. is a C Corporation. This is a federal tax classification. Other classifications are S-Corporations, Limited Liability Companies (LLC), Partnerships, and Sole Proprietorships. The vast majority of of publicly traded companies, those that are demonized for not paying taxes, are structured as C Corporations. The other classifications have limits on the total number of shareholders so they can't be publicly traded (although there are some exceptions).

C Corporations are double-taxed. They are taxed at 21% on net profit before dividends are sent to its shareholders. Then those dividends are taxed at capital gains rates, typically 15% or 20%.

An Example

Hopefully you can see that even though corporations are taxed at a much lower rate than standard payroll withholding, which can reach 35%, the profits are double-taxed. By the time the profit hits the hands of a shareholder that money has been taxed about 37%.

If I have $1,000,000 in net profit and take out the 21% corporate tax, it's reduced to $790,000. Let's say we issue that $790,000 in dividends and assume those individuals pay the 20% cap gains rate. The original $1,000,000 is reduced to $632,000 - or about 37% less than the original net profit.

Federal Tax on Corporate Profit

| Net Profit | 1,000,000 |

| 21% Federal Tax | - 210,000 |

| After-Tax Profit | = 790,000 |

Federal Tax on Shareholder Dividends

| After-Tax Profit | 790,000 |

| 20% Capital Gains Tax | - 128,000 |

| Shareholder Profit | = 632,000 |

632,000 ÷ 1,000,000 = 63.2% (or 36.8% tax)

C Corporations cannot subtract dividends from their net profit. If allowed, they could essentially reduce their tax liability to zero. Dividends are after-tax profit only.

This example also doesn't take into account state or local taxes, which can have a substantial impact depending on the state.

Dividends

Where do dividends go? The super-rich? Sure. Jeff Bezos owns about 12% of Amazon. For a company with just over a trillion dollar market cap that's about $120 billion in value. Institutions, however, own 57% of regular shares and 68% of float shares (those available to trade on the market). There are 3,684 institutions holding shares and they own the vast majority of Amazon stock.

Those institutions are comprised of private equity groups, pension plans, retirement funds, and others. I'm pretty sure I want my parents' pension plans and my retirement funds to grow.

At this point, you might be asking "Matt, if an evil corporation shows zero profit then how do they have money to pay dividends to my retirement plan?" Great question. And this is why tax law is so complicated.

Achieving Zero Tax

When a company achieves zero tax that means they're using the money for something else, such as, research and development, capital improvements, real estate purchases, etc. But achieving zero tax doesn't necessarily mean they have no money for dividends. It all depends on how they record revenue and expenses.

The IRS allows corporations to keep two sets of books. One for financial and one for tax purposes. This is where deferred tax liabilities come into play. And deferred tax liabilities are the primary reason big companies can avoid paying taxes.... for now. Eventually, those deferred liabilities catch up and have to be paid.

Let's say a company buys equipment worth $10,000. On their financial books they depreciate that over 10 years. That means they'll only record $1,000 of the expense each year. The initial $10,000 immediately comes out of their cash account but the depreciation allows their immediate financials to look better. Since that equipment will be used over 10 or more years the depreciation evens out the big upfront hit.

When that depreciation is recorded for tax purposes, they can actually claim more than what their internal financials show. The IRS allows an accelerated depreciation of assets called MACRS. Instead of claiming $1,000 from depreciation expense, they can claim $1,800. At 30% this creates a deferred tax liability of about $240

Let's say they make $1,800 in profit in year 2. With their $1,800 depreciation expense they can technically have zero tax for the year and issue $1,800 in dividends.

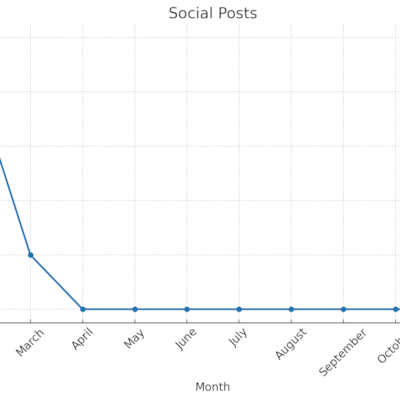

Eventually, all the deferred tax liabilities come due. This is why for 2018 Amazon paid zero in taxes but for 2019 they paid $162 million. Some of those deferred liabilities were due.

Continued Investment

But Amazon made over $13 billion and only paid $162 million in taxes! That's only 1.2% and the headline of the Yahoo article. It is very misleading for two reasons - it doesn't look at the picture over the course of several years and the business hasn't closed.

Over the course of several years, the business incurs expenses for investments in research and development, capital improvements, real estate, and other assets. Amazon certainly has spent enormous sums of money over the last 20 plus years building it's empire. And it has grown substantially, year over year. When a company grows like Amazon it incurs larger and larger depreciated expenses which essentially overtake the smaller deferred tax liabilities they incurred in prior years.

If the business was closed then all those deferred tax liabilities get added into the final tax docs, along with any final revenue and expenses. Of course, if a business is closing, it's probably not doing well and showing major losses which might offset deferred taxes.

At some point, a business owes for all those deferred taxes. If it keeps growing and spending money to grow more it will continue to show low tax expenses. If grown stagnates, however, those deferred tax liabilities will have to be paid.

Loopholes

Of course, there are loopholes in certain industries that may no longer be equitable for everyone. Some loopholes may be used to prop up an industry that's suffering from unexpected or uncontrollable circumstances. Some may be setup because the price of a commodity like corn is getting out of hand and the government wants to stabilize it. Many of these loopholes or subsidies have a sunset clause but many don't and should be reviewed annually.

One of the big loopholes was for overseas income and offshore tax havens. The United States' high corporate tax rate helped contribute to some of this. Now that it is lowered from 35% to 21% we should hopefully see more income reported in the U.S.

Why It's a Good Thing

But even with the loopholes, companies achieving zero tax should be celebrated because it can be the result of so many other positive things.

I hope at this point you're not still screaming "but they're not paying any taxes!" If so, you weren't paying attention. The only reason they get to pay little to no taxes is because they've been investing heavily into things like people and machinery and real estate. And that has a trickle down effect effect for everyone.

Let's try to stay focused and not be triggered by what I'm about to say. This is the essence of trickle down economics. When companies invest, new workers and existing workers get more opportunities, new and old businesses get contract opportunities, retailers get to sell more, manufacturers get to make more things, coffee shops sell more $6 coffee, car dealers sell more cars, and local towns and cities get more tax revenue to build and maintain schools, roads, and support services.

The rich certainly get richer, but so does everyone else down the line. If you want to be one of the rich getting richer, you can. This is America. Go out on your own. Put in the time and take some risks. If it pays off you too can be one of the rich folks.

With more businesses investing, the labor force has more opportunity to improve their own situations. Right now, we have the lowest unemployment in 50 years and companies are fighting for skilled workers and paying them more. When the available labor pool is shallow people benefit. When the available labor pool is deep and unemployment is high, companies don't have to work so hard or pay so much for their work force.

So, let's start celebrating companies who achieve zero tax because they are growing and investing. We all benefit when that happens.